wyoming llc tax rate

If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect. 1 Recognized built-in gains and 2 Excess passive.

Corporate Tax Rates By State Where To Start A Business

Talk to a 1-800Accountant Small Business Tax expert.

. There is no tax except in two limited circumstances. The tax is calculated at a rate of two-tenths of one mill on the dollar based on the value of your LLCs assets located in Wyoming. The state of Wyoming charges a 4 sales tax.

It applies to all the earnings you withdraw from your business. Taxes will be filed at the end of the year on Form 1040-NR. Versus other states in the country.

The current self-employment tax rate is 153 percent. Tax rate charts are only updated as changes in rates occur. There is no tax to the LLC on LLC income.

Sources to the Internal Revenue Service. Personal Service Corporations may be taxed at a different rate. Nonprofit Corporations and Cooperative Marketing Associations.

Delaware also charges a franchise tax also known as an annual registration fee or a renewal fee. The median property tax in Wyoming is 105800 per year for a home worth the median value of 18400000. There is a minimum license tax is 50.

On top of that rate counties in Wyoming collect local sales taxes of up to 2. Answer 1 of 3. For any income under 60000 the graduated tax rate is between 22 to 555 The maximum income tax rate is 660 on income of 60000 or over.

Additionally counties may charge up to an additional 2 sales tax. If your company has weathered a few tax seasons you know frustrating and confusing self-employment tax is. Thus on average Wyomings sales tax rate comes to a little over 5.

Tax amount varies by county. LLCs with 300000 of Wyoming assets or less pay the 60 minimum fee. For complete details on state taxes for Wyoming LLCs visit Business Owners Toolkit or the State of Wyoming.

Learn about Wyoming tax rates rankings and more. What tax rate will be applied to a Wyoming LLC owned by a non-US citizen non-resident UAE citizen resident who dropships products from China to the US and EU. One tax rate of 21 applies to taxable income.

Wyoming LLCs pay a 30 percent tax on all income from US. LLC profits are not subject to self-employment taxes but any profits distributed to owners as dividends are taxable at the appropriate capital gainsdividend tax rates. Making it one of the cheaper sales tax states.

Sales Use Tax Rate Charts Please note. Wyoming does not require an operating agreement nor are there additional documents to file with the state. Annual Report License tax is 60 or two-tenths of one mill on the dollar 0002 whichever is greater based on the companys assets located and employed in the state of Wyoming.

The state sales tax in Wyoming is 4 tied for the second-lowest rate of any state with a sales tax. Counties in Wyoming collect an average of 058 of a propertys assesed fair market value as property tax per year. All members or managers who take profits out of the LLC must pay self-employment tax.

This guide will quickly teach you the major mechanics of how your taxes and this tax calculator work how we calculated your tax rate and where you can start saving. With corporate tax treatment the LLC must file tax return 1120 and pay taxes at the 2018 corporate tax rate of 21 percent. The tax is either 60 minimum or 0002 per dollar of business assets whichever is greater.

Then you are going to like this tax advantage of Wyoming. For residential and commercial property the tax collected is 95 percent of the value of the property. Because the Wyoming sales tax rate is low.

The table below shows the total state and county sales tax rates for every county in Wyoming. All profits or losses pass through and are taxed to the members. And local governments can add on to the base.

Each year youll owe 50 to the State of Wyoming to keep your Wyoming company in good standing and 125 a year to us as your Wyoming Registered Agent. For more details on how to compute and pay the tax go to the SOS website. Wyoming does not place a tax on retirement income.

A Wyoming LLC also has to file an annual report with the secretary of state. We include everything you need for the LLC. This tax is administered by the Federal Insurance Contributions Act FICA which covers Social Security and Medicare and other benefits.

This is the state requirement but a local mill levy rate MLR is added based on each areas rates for residential and commercial property. 058 of home value. All members or managers who take profits out of the LLC must pay self-employment tax.

For industrial lands this percentage goes up to 115 percent. The annual report fee is based on assets located in Wyoming. The state of Wyoming charges a 4 sales tax.

Wyoming has no corporate income tax at the state level making it an attractive tax haven for incorporating a business. Wyoming LLCs pay a 30 percent tax on all income from US. If you are not resident in the US your Wyoming LLC will only pay tax on US-sourced income.

Explore data on Wyomings income tax sales tax gas tax property tax and business taxes. Wyoming has no corporate income tax at the state level making it. Articles of IncorporationContinuanceDomestication 5000.

9 rows Tax Rate 0. Our 49 Registered Agent Service 50 Annual Report. Up to 10 cash back The cost is 50 or two-tenths of 1 mill on the dollar 0002 whichever is greater based on the portion of the LLCs assets located and employed in Wyoming.

This will cost you 325 for a corporation or an LLC. In conjunction with the annual report you must pay a license tax. How This LLC Tax Calculator Works.

If your business is responsible for collecting and remitting Wyoming sales tax you need to register with the Wyoming Department of Revenue. The states base rate is 4. If you are not resident in the US your Wyoming LLC will only.

Every year after the first LLCs must file a 50 Annual Report with the Secretary of State. Federal tax identification number EIN.

Tax Rates To Celebrate Gulfshore Business

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

10 Best States To Form An Llc Infographic Business Infographic States Infographic

Corporate Income Tax Definition Taxedu Tax Foundation

Wyoming Sales Tax Small Business Guide Truic

5 Smart Things To Do With Your Refi Savings Smart Things Things To Do Done With You

State Income Tax Rates Highest Lowest 2021 Changes

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Effective Tax Rates Social Brands Accounting Brand Stylist

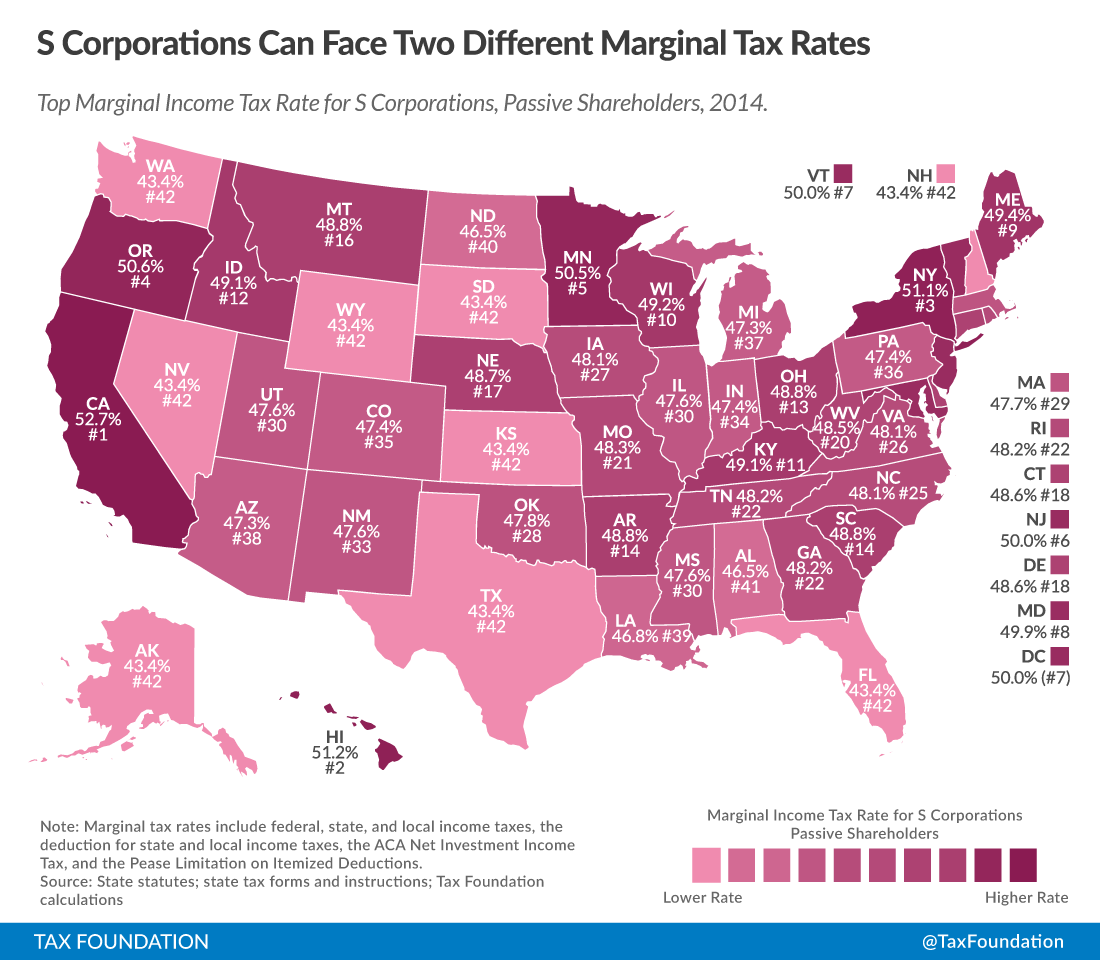

The Dual Tax Burden Of S Corporations Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

First Mover Asia Investors Flee Crypto Higher Risk Assets On Mounting Ukraine Tensions 2022

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

How Do State And Local Corporate Income Taxes Work Tax Policy Center

2021 Corporate Tax Charges And Brackets Tax News Daily

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Income Tax Rates Slab For Fy 2019 20 Or Ay 2020 21 Ebizfiling

2022 Income Tax Brackets And The New Ideal Income For Max Happiness