child tax credit deposit date november 2021

15 opt out by Nov. November 1 for the November 15.

Annex 1 Details Of Economic And Fiscal Projections Budget 2021

Low-income families who are not getting payments and have not filed a tax return can still get one but they must sign up on.

. From there the IRS will deliver the monthly payments on the 15th of each month through. The 2021 Child Tax Credit was increased up to 3600 for children under age six and 3000 for those six to 17. 29 What happens with the child tax credit payments after.

Related services and information. October 5 2022 Havent received your payment. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit.

The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15. Ad Everything is included Premium features IRS e-file 1099-MISC and more. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

12 2021 Published 1036 am. The government began paying out half of the credit on July 15. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids.

13 opt out by Aug. GET FOX BUSINESS ON THE GO BY CLICKING HERE. How Next Years Credit Could Be Different.

What is the schedule for 2021. Via the Child Tax Credit Update Portal by these dates. The fully refundable tax credit which is usually up to 2000.

The IRS will soon allow claimants to adjust their income and custodial. The agency is tapping bank account information provided through individual tax returns or. The CRA makes Canada child benefit CCB payments on the following dates.

Benefit and credit payment dates. While the October payments of the Child Tax Program have been sent out many parents have said they did not receive their September check. Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers.

15 opt out by Nov. July August September and October with the next due in just under a week on November 15. But many parents want.

Simple or complex always free. 15 opt out by Oct. Enter Payment Info Here tool or.

The fifth payment date is Monday November 15 with the IRS sending most of the checks via direct deposit. November 12 2021 926 AM CBS Los Angeles. What Is The Child Tax Credit Payment Schedule.

Who is Eligible. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. Wait 10 working days from the payment date to contact us.

13 opt out by Aug. Alberta child and family benefit ACFB All payment dates. September 24th 2021 0858 EDT.

3 January - England and Northern Ireland. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The maximum Child Tax Credit payment is 300 per month for each child under age 6 and 250 per month for each child ages 6 to 17.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The opt-out date is on November 1 so if you think it may be. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or.

IR-2021-222 November 12 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November. November 15 and December 15 are the last two days for monthly. THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until November 1 2021 at 1159pm to decline it.

Generally you need to unenroll by at least three days before the first Thursday of the month in which the next payment is scheduled to arrive you have until 1159 pm. CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. 15 opt out by Aug.

File a federal return to claim your child tax credit. November 25 2022 Havent received your payment. Wait 5 working days from the payment date to contact us.

In 2021 more than 36 million American families may be eligible to receive a child tax credit. Child Tax Credit 2022. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Benefit and credit payment dates. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. Four payments have been sent so far.

Cpp Payment Dates Aug 2022 How Much Cpp Will You Get Savvynewcanadians

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

What Is The Climate Action Incentive Payment Caip Here S How It Affects Your Taxes H R Block Canada

Cpp Payment Dates Aug 2022 How Much Cpp Will You Get Savvynewcanadians

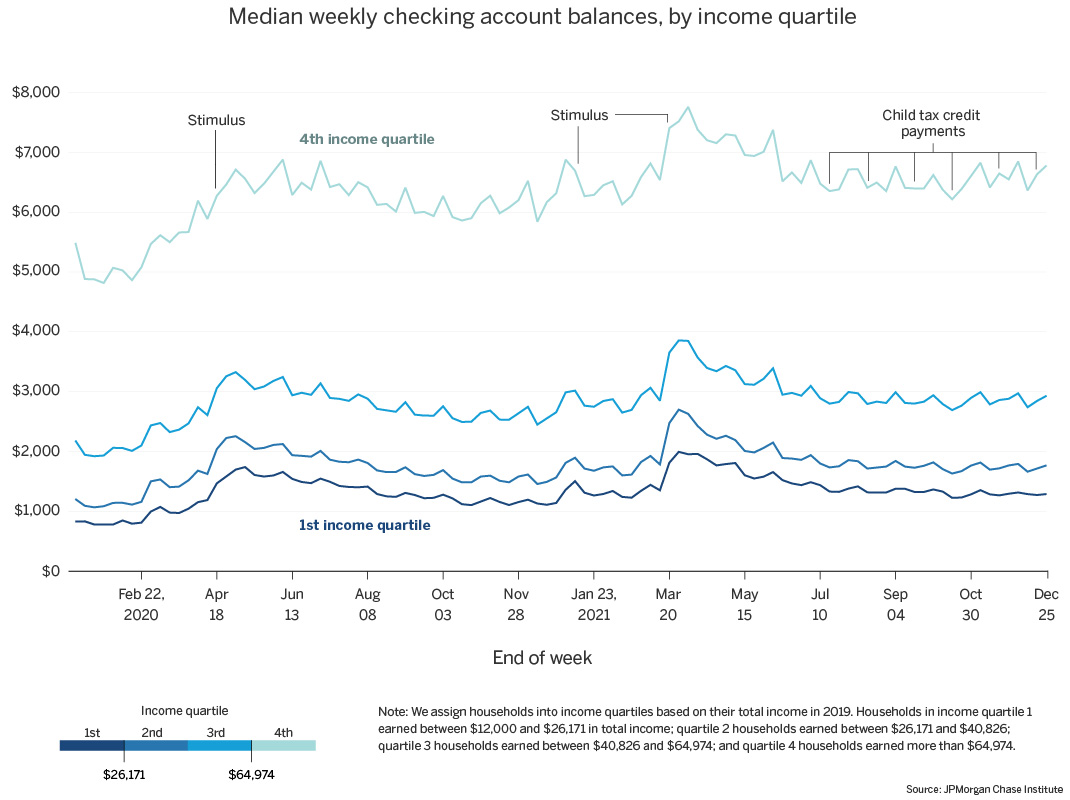

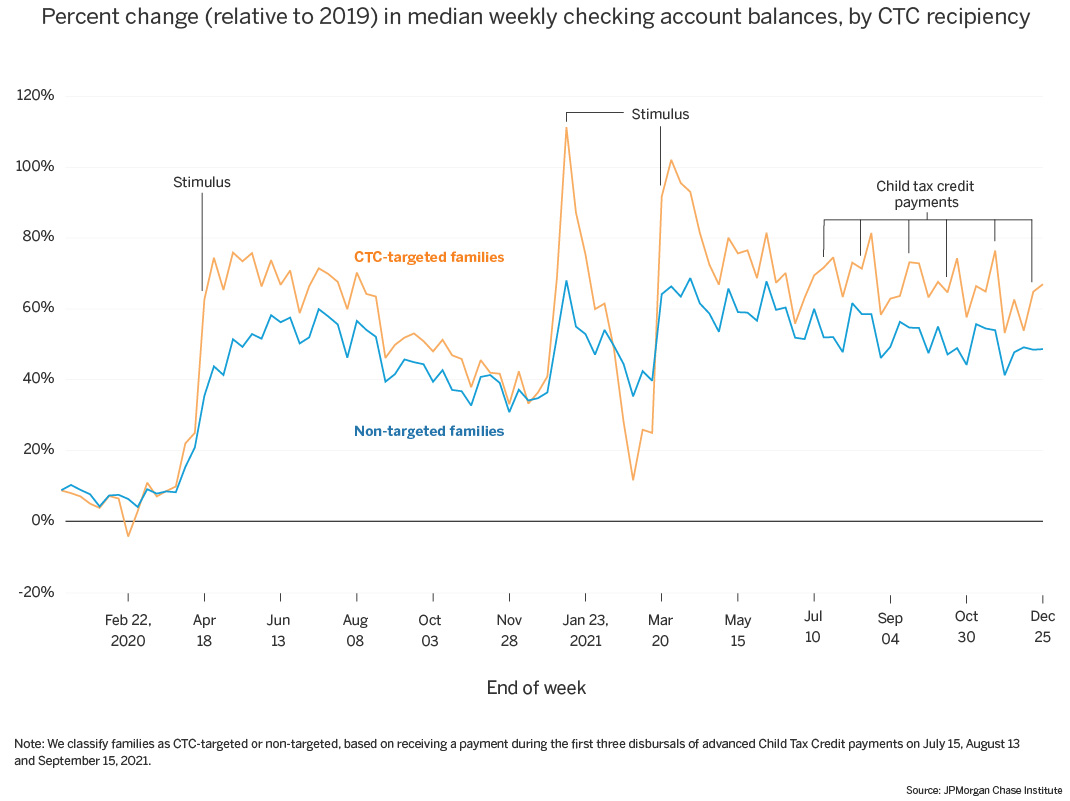

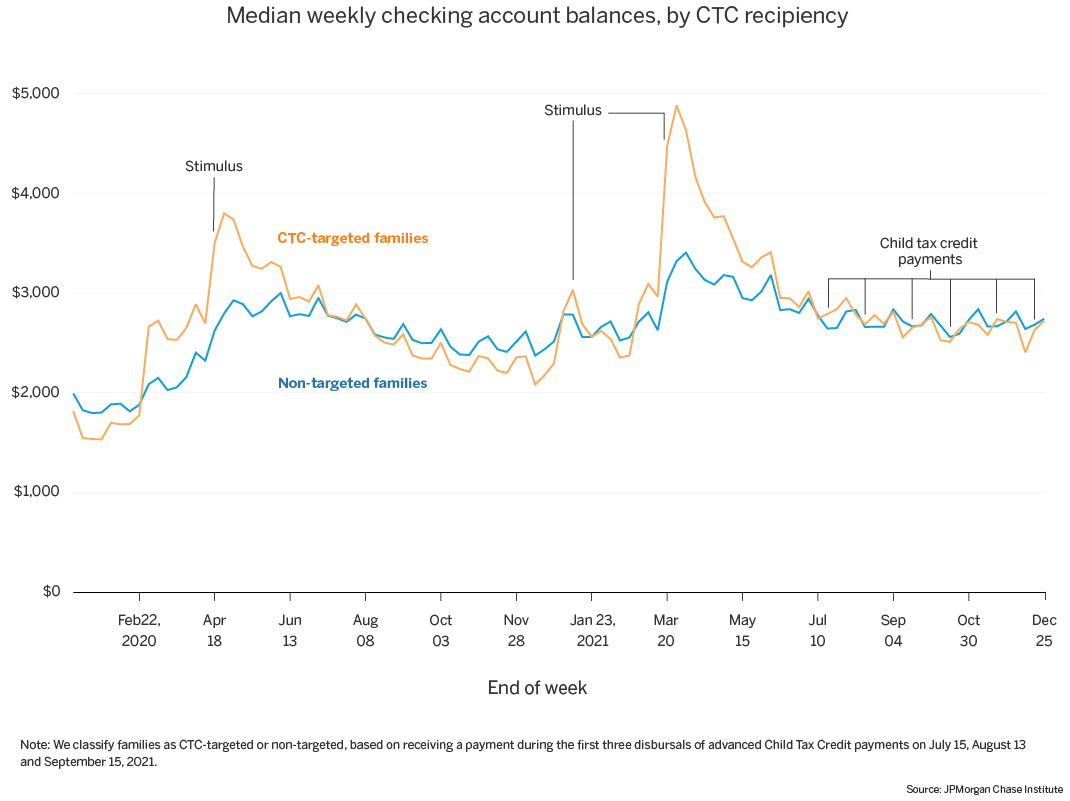

Household Pulse The State Of Cash Balances At Year End

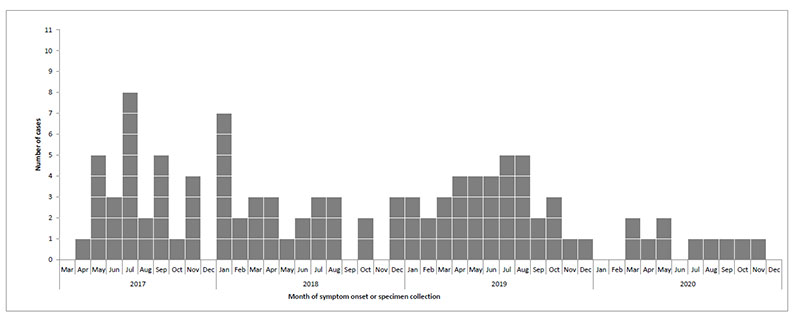

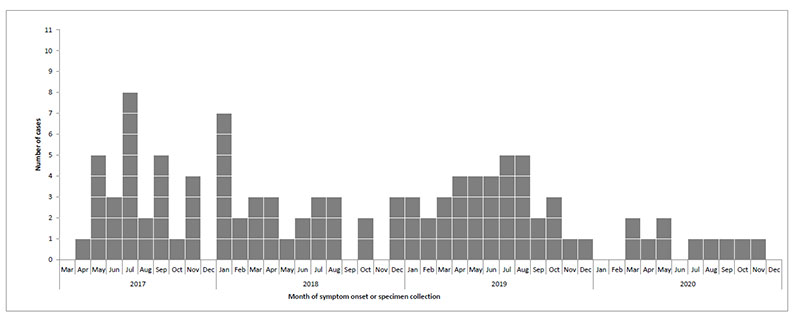

Public Health Notice Outbreak Of Salmonella Infections Linked To Snakes And Rodents Canada Ca

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

Cpp Payment Dates Aug 2022 How Much Cpp Will You Get Savvynewcanadians

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

What Is The Climate Action Incentive Payment Caip Here S How It Affects Your Taxes H R Block Canada

Household Pulse The State Of Cash Balances At Year End

Household Pulse The State Of Cash Balances At Year End

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx